Banks face physical and cyber threats that put assets, employees, and sensitive customer financial data at constant risk. Outdated bank security systems simply can't keep up with the speed and complexity of modern-day threats.

From ATM thefts and unauthorized access to compliance issues and internal fraud, the consequences of weak or outdated banking security systems are costly and damaging. Without robust bank video surveillance software and access control in place, financial institutions leave themselves vulnerable to criminals, regulatory penalties, and reputational damage.

That’s why forward-thinking banks are upgrading to advanced bank surveillance systems designed for today’s security issues. In this guide, you'll learn the essential features of modern bank security cameras, the perfect banking security solution, and what decision-makers must consider when protecting financial institutions.

Whether you're managing security internally or advising as a consultant, this guide is your blueprint for building a more secure bank.

{{cta-pop-up-component}}

How is Surveillance Technology Used in Banks?

Banks depend on surveillance technology to detect criminals as well as prevent threats before they occur. From monitoring daily operations to identifying suspicious activity, these solutions are critical for overall safety. Let’s look at how banks are putting this technology to work behind the scenes.

Protection of Customers and Staff

Banks often take a long time to build a solid reputation, and a careless mistake or serious allegation can ruin everything. That's why investing in solid bank security systems is crucial. While it helps deter potential threats, it also provides clear video evidence to address false claims, protect the bank's reputation, and reinforce customer trust.

Proactive Threat Detection

Security managers can better evaluate threats in real-time when cameras are strategically positioned to monitor the interior and exterior activities of a bank. The video footage reveals patterns that help security personnel understand potential risks and develop solutions to mitigate them.

Faster Incident Resolution

Installing bank video surveillance cameras helps prevent them from incurring financial risks and legal complications. For instance, with credit card skimming rings causing about $18 billion in annual losses, having robust surveillance systems is crucial for quick incident resolution.

Security cameras help banks resolve issues swiftly, protect their reputation, and minimize disruptions.

Protect Remote ATMs from Crime

Remote ATMs without bank security cameras are easy targets for crimes like robbery and vandalism. According to the ATM Industry Association, ATM crime incidents surged by 600% between 2019 and 2022, underscoring the escalating threat to these machines.

When banking security solutions are extended to these ATMs, financial institutions eliminate criminal behavior while giving customers greater convenience and peace of mind when using these machines.

Regulate Important Areas

Thoroughly covering a bank with security cameras increases its defense against crime. At a minimum, security managers should focus on monitoring high-traffic, high-stakes zones like entrances, hallways, teller stations, bank vaults, ATMs, restrooms, and parking lots. A well-covered bank is a far less attractive target for crime.

Stay Vigilant 24/7

The FBI's investigation into 80 'jugging' cases in 2024 emphasizes the importance of continuous surveillance to protect customers during and after transactions. 24/7 surveillance ensures nothing goes unnoticed at any point in time.

With continuous monitoring, banks can capture and review any suspicious activity, and even leverage live alerts or analytics to recognize potential threats before they escalate.

Prevent Theft, Robbery, and Vandalism

The rise in ATM jackpotting incidents, with 35 cases reported in central Illinois since September 2024, emphasizes the need for advanced security measures. By implementing bank security systems, financial institutions can minimize such on-site crimes. The perception that surveillance cameras are spread throughout the bank scares potential offenders from executing criminal behaviors.

These systems play a critical role in deterring them from committing acts like fraud, vandalism, robbery, assault, or theft. For maximum protection, any publicly accessible area should be under surveillance.

What are The Features to Look for in Bank Security Systems?

In high-risk environments like banks, the right features can make all the difference in ensuring maximum safety and responding swiftly to emergencies. Here are the must-have features to prioritize when purchasing bank security systems.

24/7 Video Monitoring

Financial institutions deal with money and sensitive data; thus, people’s financial lives are at stake. So, round-the-clock bank video surveillance is fundamental. Given that ransomware attacks cost businesses an average of $4.91 million per incident in 2024, continuous surveillance is vital for early threat detection and prevention.

Deploying a bank surveillance system with constant video monitoring ensures that every aspect of the bank is thoroughly watched, even after business hours. It helps ward off illicit activities like burglary, unauthorized access, and internal fraud. Modern surveillance cameras also include high-definition clarity, night vision, and motion sensors, guaranteeing that nothing goes unnoticed.

AI-Powered Video Analytics

Security footage is only useful if someone can make sense of it—that’s why you need an AI-driven solution. AI-powered video analytics makes your bank surveillance system more intelligent. Instead of watching endless hours of footage, AI can automatically flag suspicious activities like loitering near ATMs, unusual crowd formations, or erratic behavior.

It can also help with object tracking, facial recognition, and license plate detection. By doing so, your cameras become proactive security agents rather than just passive recorders.

Remote Monitoring

Security teams no longer have to be physically present to monitor live feeds. Modern solutions feature remote monitoring, so security managers (or bank managers) can view live footage from their smartphones, tablets, or desktops—anywhere.

This flexibility is particularly important for multi-branch banks. It promotes centralized control over all locations and encourages quick response times during emergencies.

Access Control System

Bank security systems that incorporate access control solutions regulate who can enter specific places like vaults, server rooms, or executive offices. By using keycards, biometric scanners, or other credentials, access control systems allow only authorized individuals to pass. It also keeps a digital log of entries and exits, which is helpful during audits or investigations.

Emergency Management System

Banks need an EMS that acts immediately when the unforeseen happens. Advanced banking security solutions include an emergency management system that integrates with alarms, communication systems, and lockdown protocols.

It enables staff to respond quickly and guides customers to safety. Some systems even have panic buttons and automatic alerts to law enforcement and first responders, shortening response times during critical events.

Weapon Detection System

Unfortunately, banks are among the top targets for armed robbery. That’s why the modern banking security system now includes weapon detection systems. These systems use sensors, AI, and machine learning to detect firearms or other metallic weapons at entry points.

Some are integrated with walkthrough scanners, while others analyze video footage to detect unusual objects. Upon detecting a threat, the system can trigger alerts and initiate lockdown protocols instantly.

Flexible Video Storage

With all that video footage being recorded, financial institutions need storage solutions that are reliable and scalable. Flexible video storage means the ability to store footage for quick access, backup, and long-term retention.

Also, it allows banks to scale up storage as needed, encrypt sensitive data, and retrieve old footage quickly during investigations. Thus, choosing a solution with flexible video storage is non-negotiable.

Compliance and Data Security in Banking Surveillance

Surveillance in banks also involves staying on the right side of the law. In the United States, banks must comply with a combination of federal and state laws. Here's what banks must consider to stay secure and compliant regarding surveillance.

1. Gramm-Leach-Bliley Act (GLBA)

A 2024 report revealed that 97% of the top 100 U.S. banks experienced third-party data breaches, highlighting the importance of stringent data protection measures. The GLBA demands that financial institutions protect sensitive customer data. It comprises two key regulations:

- Safeguards Rule: Here, banks are required to develop a written information security plan that addresses how customer data is protected.

- Financial Privacy Rule: Requires financial institutions to disclose their information-sharing practices and protect non-public personal information.

Regarding bank surveillance systems, this means making sure that video data, particularly if it captures customer transactions or interactions, is securely stored and access is strictly controlled.

2. Payment Card Industry Data Security Standard (PCI DSS)

Although this is not a federal law, PCI DSS is a set of security standards for any organization that manages credit card details. It emphasizes:

- Secure storage and transmission of cardholder information

- Regular monitoring and testing of networks

- Implementation of solid access control measures.

Banks must check that security systems, especially those monitoring areas where cardholder data is processed, comply with these standards to avoid data breaches.

3. Bank Secrecy Act (BSA)

The BSA mandates financial institutions to assist government agencies in detecting and preventing money laundering. This includes:

- Keeping records of cash purchases of negotiable instruments

- Filing reports of cash transactions over $10,000

- Reporting suspicious activity that might signify money laundering or tax evasion

Surveillance footage can be an essential tool in identifying and documenting such activities, making secure and compliant storage essential.

4. Federal Financial Institutions Examination Council (FFIEC) Guidelines

The FFIEC provides a framework for assessing the security and resilience of financial institutions. It recommends:

- Implementing multi-factor authentication

- Conducting regular risk assessments

- Ensuring physical security controls are in place

Ultimately, surveillance systems should be incorporated into the bank's entire security strategy, aligning with these guidelines for comprehensive protection.

What Makes Coram the Ideal Security Solution for Banks?

Banks and financial institutions require a smart, unified system that proactively protects assets, people, and sensitive data. That’s why you should choose Coram.

- Unified Security

Coram combines video surveillance, access control, and emergency management into one standalone platform. This eliminates the need to juggle separate platforms.

Whether you're managing a single bank branch or multiple nationwide, Coram’s all-in-one banking security solution simplifies your infrastructure, making it easier to monitor, respond, and protect in real-time.

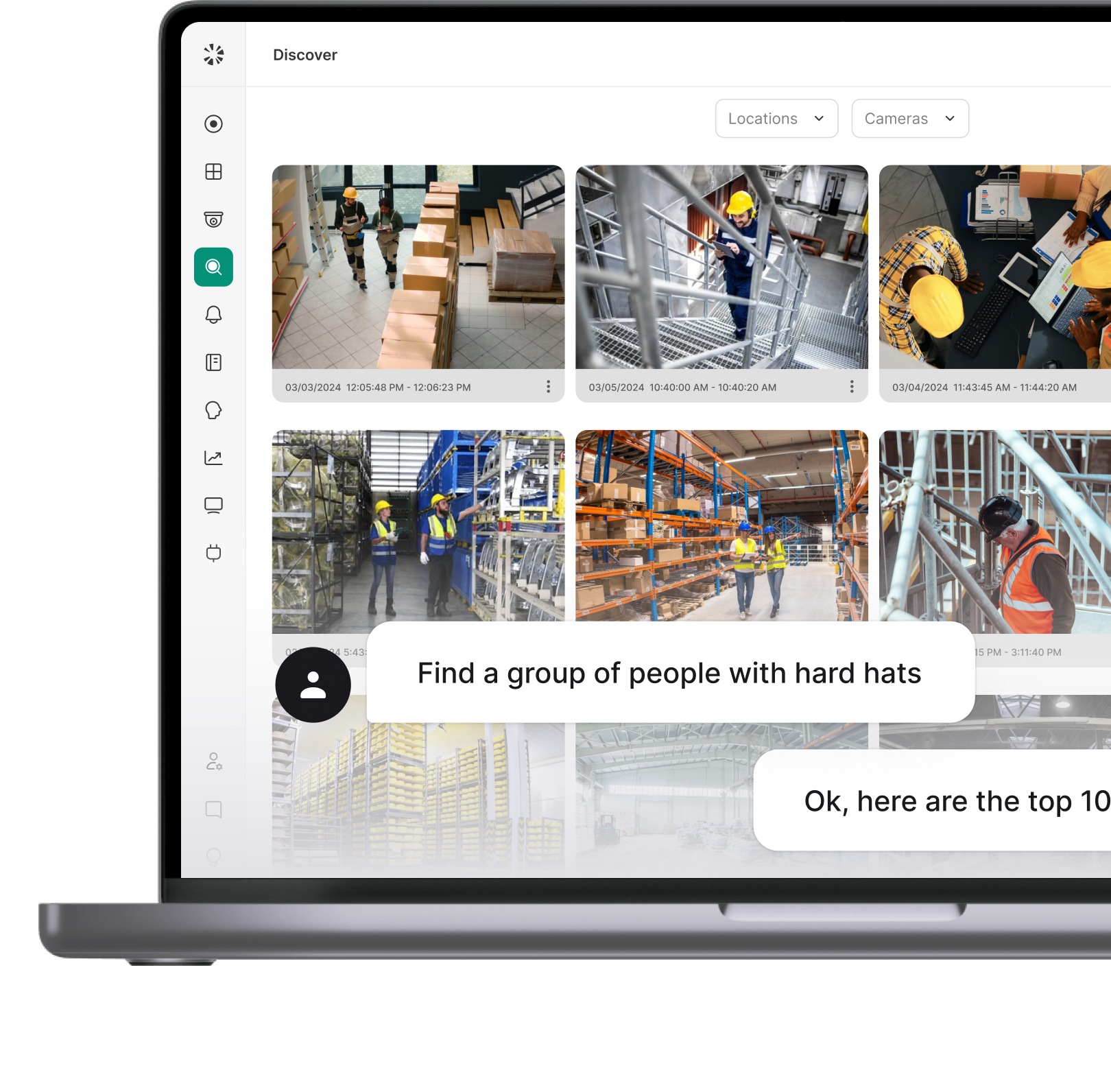

- AI-driven Surveillance

Coram’s wireless IP cameras offer easy, cable-free installation with NDAA and ONVIF compliance. Hence, you're guaranteed security without vendor lock-in. These bank security cameras capture clear footage day or night and support AI-powered features such as firearm detection, intrusion alerts, and facial recognition.

This way, financial institutions can detect suspicious behavior instantly and trigger automated emergency protocols when needed.

- Automated Emergency Response

With Coram’s Emergency Management Software (EMS), bank staff can trigger alerts discreetly from any device. If a threat like an armed intruder or unauthorized access is detected, lockdowns can be initiated instantly, either manually or automatically through camera-detected incidents. Financial information is sensitive, and Coram ensures that sensitive financial information remains secure.

- Access Control that Adapts to Your Security Needs

By using Coram’s cloud-based access control solution, banks can control who gets in, when, and how. This can be done using biometric data, keycards, or mobile credentials customized per user.

In addition, managers can schedule access, manage permissions remotely, and instantly revoke access when required. Coram's system even captures entry attempts, time stamps, and integrates with video surveillance to detect tailgating.

- Scalable and Flexible

Whether you're expanding to new branches, a new city, or onboarding new employees, Coram scales with your financial institution. It also functions during power or network outages, which guarantees uninterrupted security.

- AI-Powered NVR for Cost Efficiency

Coram’s AI NVR, Coram Point, works with any existing IP camera, instantly enhancing your security with modern AI capabilities, meaning you don't need to replace your current setup. It’s designed to evolve with future AI updates, offering better performance, all while reducing operational costs.

In a financially sensitive industry like banking, security solutions should be smart, connected, and proactively defensive. Coram delivers exactly that.

Wrapping Up

Securing a bank requires a smart, reliable, and futuristic surveillance system. With features like round-the-clock monitoring, AI-powered analytics, remote access, and compliant data security, the right banking security solution empowers you to overcome security threats and emergencies. Coram delivers all these, and more.

Designed for highly sensitive industries like banks, Coram delivers a unified, robust bank video surveillance solution that's scalable and fully compliant. If you’re looking to stay ahead of threats while safeguarding your employees, customers, assets, and data, Coram is the partner you can trust. Try Coram for free today!

.webp)